Audi closed 2025 facing a somewhat uneven global picture—one that highlights both the depth of its current challenges and the limits of its remaining strengths.

HARD YEAR IN THE UNITED STATES

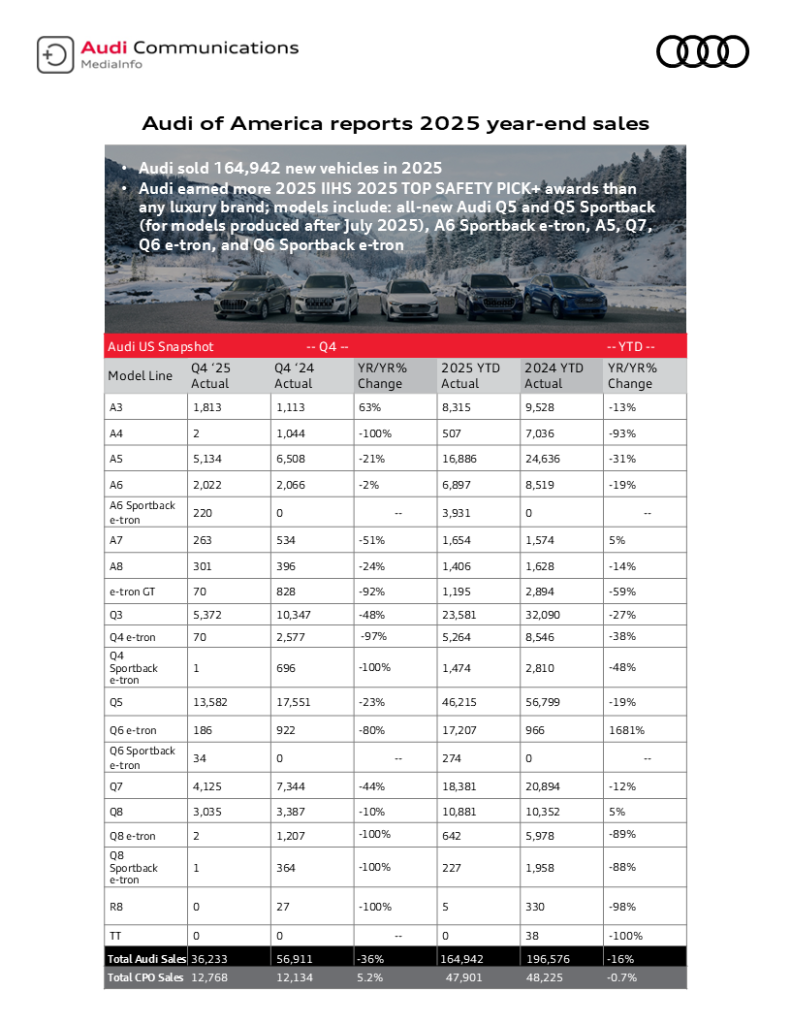

According to year-end figures released by Audi of America, Audi delivered 164,942 vehicles in the U.S. in 2025, down 16 percent year over year from 196,576 units in 2024. The fourth quarter was particularly difficult, with sales down 36 percent compared to Q4 2024.

Even more challenging, the decline was broad-based and doesn’t center around a specific poorly received model, model cycle or supply interruptions.

- Core sedans like A4 (-93% YTD) and A5 (-31% YTD) continued to lose ground.

- SUVs, long Audi’s volume backbone in the U.S., also weakened. Q5 sales fell 19 percent, Q7 dropped 12 percent, and Q3 declined 27 percent year over year.

- Audi’s EV portfolio struggled sharply. Q4 e-tron (-38%), e-tron GT (-59%), and Q8 e-tron that ended production (-89%) all posted declines, reflecting both soft demand and product-cycle headwinds.

Audi highlighted a bright spot in safety recognition, earning more IIHS Top Safety Pick+ awards than any other luxury brand in 2025, including for updated Q5, Q5 Sportback, A6 Sportback e-tron, and Q6 e-tron models built after July. But safety accolades alone couldn’t make up for the slide: Audi’s U.S. business shrank materially in a market that remains fiercely competitive, now laden with tariffs and one that’s increasingly polarized between legacy ICE loyalty and next-generation EV leaders.

LEADING IN LUXURY ICE – FOR NOW IN CHINA

In contrast, FAW Audi closed 2025 with headline-grabbing results in China. Retail sales reached 570,088 units, with wholesale deliveries of 566,988 units, allowing Audi to reclaim the top position in China’s luxury fuel-vehicle segment for the first time in six years—and the overall luxury market crown for the first time in seven.

Key contributors included:

- Audi A6L: 172,000 units, the best-selling luxury C-segment sedan in China.

- Audi Q5L: 140,000 units, leading the luxury B-segment fuel SUV category.

These results reinforce Audi’s strength in China’s long-wheelbase and locally tailored ICE models—products precisely aligned with traditional luxury demand.

However, even this success comes with a caveat. China is rapidly accelerating toward electrification, with domestic brands and tech-forward EV players reshaping consumer expectations at a pace unmatched elsewhere. Audi’s leadership in fuel luxury cars, while meaningful today, sits on increasingly unstable ground as the market pivots decisively toward electric, software-defined vehicles.

FAW Audi is responding with its dual-track “oil and electricity” strategy, rolling out the PPC fuel platform alongside the PPE electric platform, and leaning heavily on localized technology partnerships—including Huawei-based driver-assistance systems. Yet the strategic tension is clear: Audi’s strongest market position is anchored in a segment China is actively moving beyond.

BRAND IN TRANSITION

Taken together, Audi’s 2025 results reveal a brand caught mid-stride. In the U.S., the fear is that Audi is losing relevance faster than new products can arrive. In China, the brand remains formidable—though here the challenge is that strength of internal-combustion models in a market that increasingly rewards EV leadership and domestic innovation could be short-lived.

All that said, relief is coming… at least in part. Audi has confirmed a wave of new product launches slated for the near term, including RS 5, RS 6, Q7, SQ7, Q9, and SQ9. These vehicles will help refresh showrooms, particularly in North America where the brand hopes to reassert Audi’s performance and luxury credentials.

Still, the broader takeaway from 2025 is sobering. Audi is not short on engineering capability or brand equity—but the global market is moving fast, all while a long-term move is to shift its current portfolio to the brand’s signaled “radical simplicity” direction. Given all this, the challenge will be less about reclaiming past leadership and more about proving relevance in a luxury landscape being rewritten in real time.