With the start of the 2025 NFL season, the lights of Northwest Stadium will be brighter than ever. Banners will drape the arches, giant Audi logos will flash on digital boards, social media reels will be lit — all bearing Audi’s name as the “Official Partner of the Washington Commanders.” In the swelling noise of pregame, thousands of fans will cheer, hundreds more will jostle under the gleam of sponsorship. In that moment, the Audi presence will be there for all to see.

Audi’s partnership with the Commanders isn’t its first brush with the NFL. Over the years, the brand has leveraged football’s biggest stage with memorable Super Bowl commercials. Those ads weren’t just about name recognition—they were product-driven campaigns that introduced millions to the halo R8 supercar or spotlighted the then-new TDI diesel technology. In those moments, Audi wasn’t simply sponsoring a game; it was educating and inspiring a nationwide audience about what set its cars apart.

That shift—from national, product-focused storytelling to a local hospitality sponsorship—underscores a notable priority shift. Where once Audi used football to showcase its engineering and vision, today its investment manifests as a lit logo in the Commanders’ Tunnel Club.

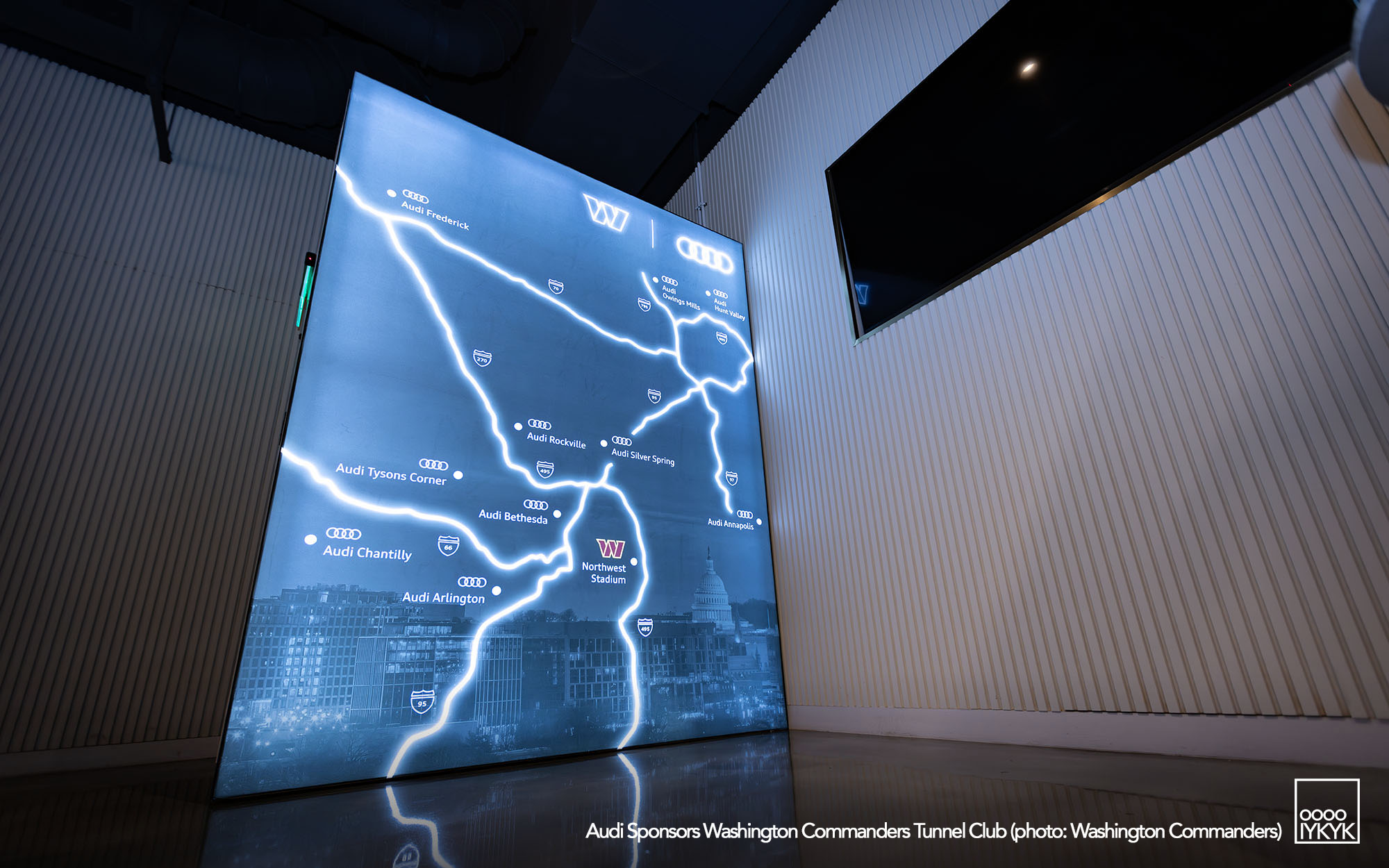

Now the Audi Tunnel Club, it’s an exclusive, members‐only space just outside the Commanders’ locker room. Fans here see players storm the field, enjoy pregame access, mingle with executives, and even get swept along in the away‐game buzz. Audi also gets its badge in all the right places: stadium signage, game‐arrival video spots, Legend‐spotlight interviews, social media crosshairs. On paper: premium placement, emotional alignment, visibility.

The question becomes whether such placements create lasting brand affinity and repeat buyers, or if they amount to expensive wallpaper that does little to convert fans into drivers. Or is it just a flashy touchpoint amidst a sales slide?

Because yes — Audi’s car sales are down, substantially.

- In Q2 2025, U.S. Audi sales were down 19% year-over-year, a sixth straight quarterly decline (source: CBT News)

- Over the first half of 2025, Audi sold about 81,951 vehicles in the U.S., a drop of 12% compared to the same period in 2024 (source: BMW BLOG)

- Model by model, many of Audi’s stalwarts are shrinking: the Q5 (once its bestseller) dropped nearly 29% year-over-year in Q2.

So there’s the tension. Audi is investing in brand visibility via big partnerships with sports teams and stadium entitlements. But its core product sales are moving in the opposite direction.

Is that surprising? Not really. Visibility is necessary but is it insufficient? Sponsorships can bring awareness, affinity, perhaps some halo effect. But, converting that into a buyer — particularly a repeat one — depends on other factors: product desirability, reliability, pricing, dealer experience, resale value, how the brand treats its enthusiast base, etc.

Editor’s Note: This is a communication platform for Audi aficionados and enthusiasts. In that, there is a clear editorial leaning that no doubt informs opinions on this site. So, in an experiment, ChatGPT was utilized to dig further into researching the validity of those opinions while validating any answer with sources and data. This is a long piece. The ChatGPT derived study goes much further, but an effort was to make this streamlined. I hope you find it enlightening.

CREATING FANS, BUT ARE THEY FANS OF AUDI?

Here’s where the story gets interesting. Enthusiasts — people who care deeply about the cars themselves: how they’re designed, how they handle, what equipment they have such as safety or performance features, what personalization is possible, the culture and the community around them — often form a kind of emotional backbone for a brand’s prestige and word-of-mouth recommendation. Enthusiasts are early adopters; they keep interest alive; they often persevere through teething problems or odd design choices because they believe in the brand.

Yet, in the advent of the electromobility era, emphasis on car enthusiasts has fallen out of vogue in brand marketing strategies. More traditional car enthusiasts are often EV skeptics, and with EV goals having taken top priority these last few years, a lack of nuanced understanding that EV skeptics don’t represent all car enthusiasts can make giving up car enthusiasts entirely the easy button, closing the tap on growing brand enthusiasm. This risks alienating existing owners on large scale, meaning also likely the all-important repeat buyers. For a cash-strapped brand within an industry where owner retention is dramatically cheaper than conquest sales, the risks of giving up entirely on car enthusiasts should be obvious.

Except it’s not. In recent years, Audi of America has been noticeably less visible in this world: Monterey Car Week, concours, shows, owner’s clubs, track-days. About the same time the brand’s first EVs began to arrive on these shores, it shuttered its motorsport experience events at races like the 24 Hours of Daytona and 12 Hours of Sebring, closed down its driving experience at Sonoma Raceway, ended its European delivery program and ceased funding its owner’s club. The brand’s emphasis on communicating the Audi brand to the automotive media also appears to have been cut back.

Each of these are instances where the car is the experience, not just the sign on the wall, the logo on a jersey or the stanchioned obstacle to walk around as you make your way into a game. It’s where someone who loves cars can confirm their decision for one of their largest investments, test the brand’s mettle, feel proud of their ownership decision, and tell others – from enthusiasts to associates seeking advice from a familiar car expert. And while social media influencer focus hasn’t been slashed as drastically, proof of generation of brand enthusiasm is at best highly nebulous when measured in commodity media impressions on social platforms.

By leaning heavily into big sponsorships (tunnel clubs, stadium branding, digital content), Audi may be aiming for broad reach and premium associations — but possibly at the cost of turning its back, or at least deprioritizing, the very audience that cares not just about seeing the brand but about being part of its mechanical, aesthetic and emotional identity.

What kind of buyer does stadium and sports sponsorship reach — and what kind does it miss?

- “One-time buyer with brand appeal”: For someone who sees the Audi logo at the stadium, associates it with prestige, and whose decision is influenced by image, visibility, and status, such sponsorships can nudge them. If that buyer is new to premium cars, they may get an Audi as their first, drawn by the prestige and lifestyle signal.

- Repeat buyer / enthusiast: Someone who cares about how the car drives, how it sounds, what potential it has, what ownership experience is and even how welcoming and valuable the network of ownership is. For them, seeing cars at circuits, hearing feedback in enthusiast circles, seeing and attending car-centric events matters more. If Audi isn’t engaged there, it may lose credibility with this group. That could mean fewer repeat buyers, fewer brand loyalists, less word-of-mouth positive influence among those who help a premium brand’s reputation.

- Risk of switchers: If someone buys based on image, then has a bad experience — with the car, dealer, service, reliability, or resale — nothing in a stadium sponsorship necessarily holds them. Especially in the premium segment where alternatives are numerous, brand switching is relatively easy and frequent.

IS AUDI ON THE RIGHT TRACK?

Audi is making a reasonable but risky bet.

- On the plus side, sponsorships like the new one with the Commanders is expected to build visibility, align the brand with lifestyle and prestige, and may reach people who wouldn’t walk into a dealership otherwise. There’s value in that. For a premium brand, perception and status still matter a lot.

- On the other hand: with sales declining, the risk is that while money is spent to create impressions, that investment doesn’t sufficiently convert into sales or loyalty, or doesn’t shore up core weakness (product gaps, poor dealer experience, unreliability, pricing). If the enthusiastic base feels ignored, that can erode the brand’s authenticity, word-of-mouth, and longer term resilience — especially at a time when EVs are clearly not the sure thing they once seemed to be.

- Also, the economics of sponsorships are expensive. If the return on investment is weak — say, lots of impressions but few or no repeat customers — then those dollars might have been more effective elsewhere (product development, engaging the enthusiast base, improving dealership experience, etc.).

SPORTS FANS VS. CAR FANS. CONQUEST VS. RETENTION.

When choosing between spending on sports sponsorships (visibility, prestige, logos) vs. building enthusiast communities, loyalty programs, or product-centric experiences, retention is usually far more profitable, more stable, and more strategic for premium brands. Here’s why:

- Lower Cost Per Sale

Retaining an existing customer is much cheaper than acquiring one from another brand (a conquest buyer). The costs to attract a conquest buyer include heavier incentives, dealer mark-downs, higher marketing spend, sometimes “premium” pricing to counter perceived value gaps. For retained customers, many of those costs are already sunk: brand perception, service experience, even emotional attachment. - Higher Margin / Better Deal Structure

Existing customers often accept less incentive, are less likely to negotiate hard, trust the service network, and are less incentive-sensitive. Conquest buyers might demand special discounts or “pull ahead” payments, which erode margin. - Compound Value Over the Ownership Lifecycle

A loyal customer is more than one car sale:- They bring repeat purchases over many years.

- They contribute to service, parts, warranty, and accessory revenue.

- They are more likely to recommend the brand (word-of-mouth).

- Survival During Downturns / Competitive Pressure

In periods of soft demand, supply constraints, or model transition (for example, when a key model is being refreshed, or when electric models are replacing gas ones), brands with high loyalty can weather the dip better. Their existing owners are more likely to wait, to accept substitutes or to stay within the brand rather than defect. - Perception of Authenticity / Brand Equity

Enthusiast ownership, owner-clubs, presence at car-centric events (track days, shows) build credibility. Sports sponsorships give prestige, but less product credibility. Enthusiasts are loud in shared culture: you see them online, in forums, in the enthusiast media. If a brand drops out of that sector, enthusiasts may feel “sold out” or disconnected. That can reduce referrals and diminish the brand’s aura. - Better Measurability and Predictability

Loyalty programs, test-drive conversions, owner feedback, and repeat purchase patterns are more measurable. If you spend money giving perks to existing owners, or improving service, you can often more directly link that to retention rates. Sports brand visibility is valuable, but harder to convert to retention metrics except over the long run, and with strong activation.

Why is this important? Audi’s loyalty rate is lagging amongst its competitors.

Loyalty & Retention Stats (Brand Comparisons)

From J.D. Power’s 2024 U.S. Automotive Brand Loyalty Study and related sources:

| Brand / Segment | Loyalty / Retention Rate* |

|---|---|

| Porsche (premium car owners) | ≈ 57.5% ‒ highest among premium car brands. J.D. Power+1 |

| Lexus (premium SUV owners) | ≈ 60.2% ‒ leading in that premium SUV segment. J.D. Power+1 |

| BMW (premium SUV) | ≈ 55.8% ‒ second in that segment. J.D. Power+1 |

| Mass-market / non-premium (e.g. Toyota, Honda) | Generally in the 60-62% range for retention in their segments. J.D. Power+1 |

| Audi* | ~43–45% in older studies. For example in 2021, Audi had about 45.5% returning buyers in the premium segment. J.D. Power+1 |

*“Loyalty” or “retention rate” means: percentage of existing brand owners who stay with the same brand for their next new‐vehicle purchase.

HOW THIS IMPACTS SPONSORSHIP VS ENTHUSIAST GROWTH

Audi’s relatively lower loyalty rate (≈ 43-45% in past studies) suggests it is spending more to replace lost buyers (via conquest), or is more exposed to buyers switching brands. Worth noting, Audi of America had already dialed back investment in enthusiast programs by 2021 when this data was collected.

Sports sponsorships give high visibility, which is good when trying to attract new customers, but they do relatively little for keeping existing ones deeply engaged—unless paired with ownership perks, service excellence, or enthusiast experiences.

Enthusiast growth, owner clubs, product experiences are especially effective for increasing retention, because they deliver on what existing owners care about: driving quality, identity, status among peers, after-sales experience.

Audi isn’t alone in grappling with brand visibility vs. customer loyalty. Several of its peers offer sharp lessons in how engaging enthusiast, ownership, and experiential channels helps drive not just awareness, but sustained retention—lowering acquisition cost, improving loyalty, and building advocacy.

- Porsche has leaned into urban experiential formats like Porsche NOW pop-ups and “Porsche Studios,” bringing its cars, its people, and its story into city centers. These aren’t temporary billboard displays; they generate leads, test-drives, and emotionally connect with people who might not initially be dealership visitors. In many cases, these touchpoints act as entry points for future owners. Porsche Newsroom

- More than that, Porsche’s community-building (exclusive events, owner stories, customized experience) helps to create a sense of ownership beyond the product itself. It cultivates emotional investment: owning a Porsche isn’t just about the car—it’s about being part of something. Those invested customers are far likelier to stay and to bring others along. news.tobeagency.co

- Lexus similarly demonstrates how owner perks amplify retention. The Lexus Encore program provides lifestyle privileges—events, hotel and dining deals, and more—that make ownership feel premium beyond the vehicle. Even modest perks can make a difference in how owners perceive value. Esquire Australia

- Lexus goes further with loyalty financial incentives in some markets. In the UK, existing owners buying another Lexus self-charging hybrid can benefit from a “Hybrid Deposit Allowance,” giving a cost incentive to stay with the brand. These kinds of programs tend to produce higher ROI per dollar spent, because they act on people already predisposed to buy again. Lexus Media Site

SUMMARY AUDI NEEDS BOTH. CHOOSING JUST ONE IS A COSTLY MISTAKE

Audi might need both: the stadiums and the fans. The big brand visibility plays a role in prestige and top-of-mind presence; the enthusiast engagement plays a role in loyalty, depth, advocacy, and retention. If Audi turns away from the automotive community that loves the actual cars — going to shows, personalizing, sharing stories, tinkering — it risks losing more than it gains in the short term, especially as buyers get more informed, more demanding, and more fickle.

If Audi continues to prioritize sponsorships without investing in retention/enjoyment and owner experience, it risks an erosion of loyalty, making future conquests more expensive — and lowering profitability over time.

Enthusiast and owner-ecosystem activations communicate that the brand cares about more than logos and status—they care about people who actually love the product. That builds authenticity, which matters ever more, especially as auto buyers become more critical, more socially connected, more digitally savvy.

Once lost, building brand enthusiasm isn’t just more costly, it is exceedingly difficult. The risk of becoming just another watered down brand no one cares about is high. Even if successful, it takes decades to rebuild as Audi already experienced in the 2000s when set in motion a decade plus strategy to recapture its mojo once earned on the back of the quattro in rally.

Simply being in the luxury space doesn’t guarantee success. Nor does an F1 team. Brands on Grand Prix grids with inauthentic automotive bonafides off track aren’t a new phenomenon in the sport, nor are the stories of their decline. F1 is an expensive party.

Simply being on the F1 grid and hoping people will still care isn’t a guarantee of success with car enthusiasts. And while that should be obvious, non-enthusiast executives relying on instinct or guidance from data inconsiderate of car enthusiasts may see F1’s media impression numbers and assume otherwise.

Given the current evidence — sales slipping, key models down — Audi doing more super-gloss placement without investing to sufficiently serve those who buy, use, and love their cars seems like a precarious strategy. It’s not wrong per se, but unless there’s a rebalancing, it may leave a gap that competitors can exploit (especially brands that do show up at car meets, support owner’s clubs, etc.).

GALLERY AUDI TUNNEL CLUB